News

Sep 16, 2024

Link between BTC and DXY

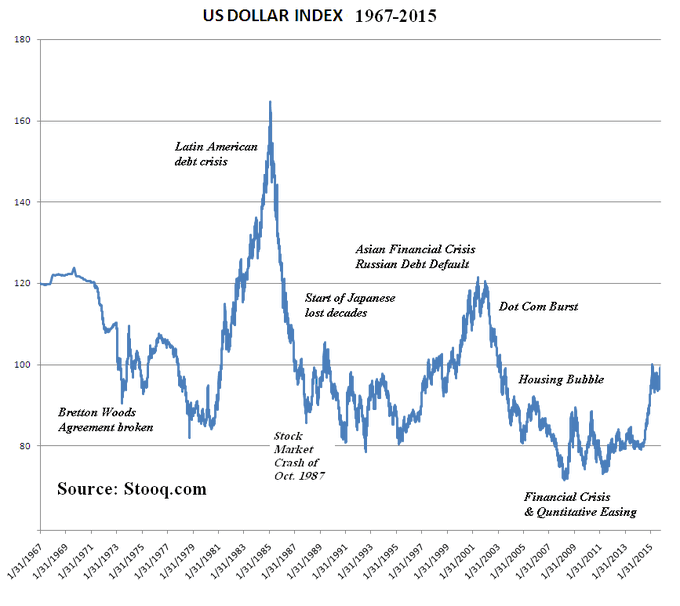

The U.S. Dollar Index (DXY) measures the USD’s value against major currencies.

It serves as an indicator of the dollar's overall strength or weakness in global markets.

By analyzing DXY, we can anticipate when BTC is likely to rise or fall.

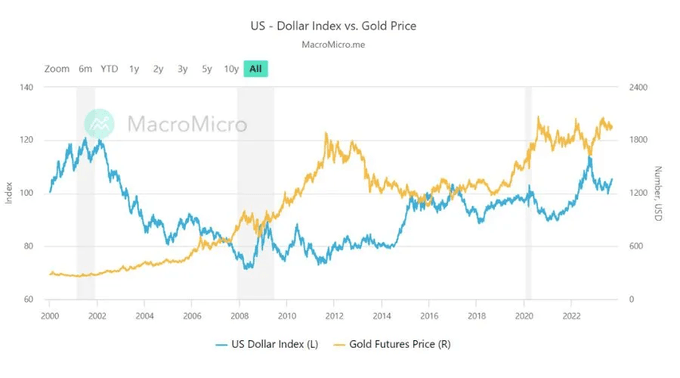

We can use this to predict Bitcoin Price Typically, they have an inverse correlation: when the $DXY rises, cryptocurrency prices tend to fall, and vice versa.

This is because cryptocurrencies are often used as a hedge against the dollar.

However, this correlation isn’t always constant and can depend on additional factors

Market Sentiment

In times of economic uncertainty or turmoil, investors seek refuge in safe assets like the USD.

Global Economic Events: This includes changes in interest rates, geopolitical tensions, and trade disputes.

Inflation Concerns

In such cases, investors turn to assets considered a hedge against inflation, such as BTC.

Regulatory Changes: Stricter regulations or negative news can lead to a drop in BTC prices, and vice versa.

How to Use DXY in Trading?

One way to use DXY is by looking for correlations with cryptocurrency prices.

Plot the DXY chart and compare it with the charts of your chosen coins to identify potential trading signals.

Another approach is to consider the broader impact of the Dollar Index on financial markets. If the Dollar Index is rising and turbulence is likely, you might consider reducing exposure to risk assets.

The Dollar Index can also be used as a risk management tool for hedging crypto positions. Expectations of a weakening DXY due to economic or political events can signal opportunities to increase BTC positions.

Keep in mind that DXY's influence isn’t limited to BTC but can affect a wide range of assets, including other cryptocurrencies, stocks, and commodities.

Monitoring the Dollar Index can provide valuable insights into market dynamics and help refine your trading strategies, especially in volatile environments.

In summary, understanding the relationship between BTC and DXY can help traders make more informed decisions, manage risks better, and potentially capitalize on market movements.

Conclusion:

Turn on notifications — hidden gems are just a click away!

Stay updated instantly on our X 👉 https://x.com/MetaverseSG.

News stream

See More NewsGet the best Alpha & Market Analysis with a FREE NFT pass

Get NFT Pass