Crypto Recap

Mar 2, 2025

Weekly Crypto Recap (Jan 24th - March 2d)

Donald Trump Announces U.S. Crypto Reserve Including XRP, SOL, ADA, BTC, and ETH

Background

U.S. President Donald Trump has revealed the first details of a strategic U.S. crypto reserve, initially naming XRP, Solana (SOL), and Cardano (ADA) as part of the reserve before later adding Bitcoin (BTC) and Ethereum (ETH).

Key Points

Trump's initial announcement named XRP, SOL, and ADA as core assets in the U.S. crypto reserve, omitting BTC and ETH.

Market reaction saw XRP, SOL, and ADA surge in price following the announcement.

Clarification on BTC and ETH came about an hour later, with Trump stating that both would also be included.

Executive Order on Digital Assets directed the Presidential Working Group to move forward with the crypto reserve, with a summit planned for Friday.

Policy implications: The move aligns with Trump's campaign pledge to make the U.S. the "Crypto Capital of the World."

- Political and financial ties: David Sacks, the White House crypto and AI czar, is linked to Solana-focused investments, and Ripple (XRP) has been increasing its lobbying efforts in Washington.

Key Takeaway

Trump's endorsement of a U.S. crypto reserve signals a major shift in government recognition of digital assets, with potential regulatory and market implications as the initiative develops.

Bybit Hacker Launders $605M in ETH, Over 50% of Stolen Funds

Background

The Bybit hacker, linked to North Korea’s Lazarus Group, has successfully laundered over $605 million in ETH—more than 54% of the total $1.4 billion stolen in the largest crypto exchange hack to date.

Key Points

Funds Movement: The hacker used THORChain, a cross-chain asset swap protocol, to move stolen funds, causing THORChain’s swap volume to exceed $1 billion.

THORChain Controversy: Critics argue that the protocol’s privacy features enable illicit transactions; one of its core developers, “Pluto,” resigned amid the growing backlash.

Validator Votes and Exit: THORChain validators attempted to block Lazarus Group transactions, but after the vote was reverted, some threatened to exit if no action was taken.

- FBI and U.S. Authorities: The FBI confirmed North Korea's involvement and urged exchanges and validators to cut off Lazarus-linked wallets.

Key Takeaway

Despite blockchain analysis exposing the Bybit hacker’s identity, the funds are being laundered faster than screening services can track, raising concerns over privacy-focused protocols facilitating illicit financial flows.

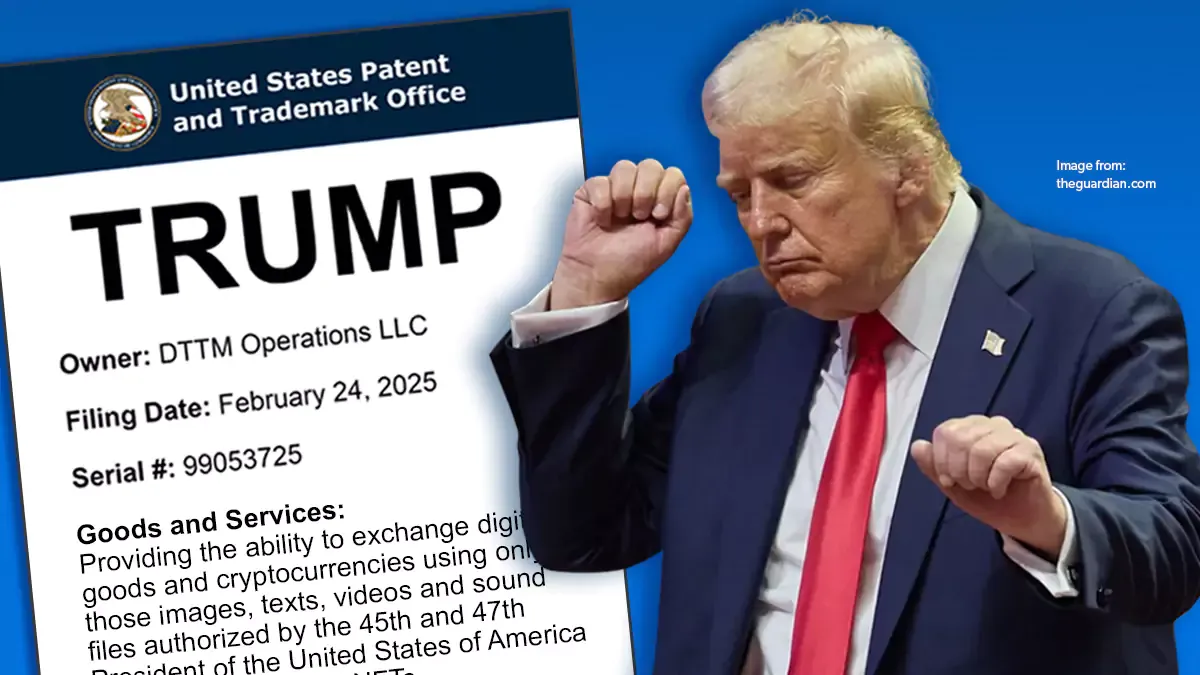

Trump Organization Files Patent for TRUMP Metaverse

Background

The Trump Organization has filed a patent for a Trump-themed metaverse, including digital goods, a TRUMP-branded restaurant, and virtual apparel for avatars.

Key Points

Filed on February 24 by DTTM Operations LLC, the entity managing Trump trademarks.

Features include TRUMP-branded clothing, shoes, hats, and business training services.

Concerns from crypto natives due to reliance on downloadable software rather than onchain access.

- Metaverse token market struggles, with SAND and MANA down 95% from all-time highs.

Key Takeaway

Trump’s metaverse ambitions signal commercial expansion, but reliance on traditional software may limit appeal among crypto-native users.

Sam Bankman-Fried Posts on X for First Time in Two Years; FTT Token Soars 30%

Background

Sam Bankman-Fried broke his two-year social media silence by posting on X (formerly Twitter) about recent mass government layoffs under the Trump administration. His return triggered a 29% spike in FTT token price, though it later retraced.

Key Points

First post since January 2023, where he commented on the U.S. government layoffs and compared them to internal mismanagement at companies.

FTT token surged from $1.60 to $2.07 following his post, before correcting to $1.77.

SBF’s legal battle continues as he serves a 25-year sentence for financial fraud but seeks a presidential pardon from Trump.

- Polymarket odds remain low, with only a 3% chance of Trump pardoning him within his first 100 days.

Key Takeaway

Bankman-Fried’s unexpected online comeback sparked market volatility, but his legal fate remains uncertain, with little indication that Trump will grant him a pardon.

Biggest Crypto Hacks of All Time

Background

Crypto remains a prime target for hackers and exploiters, with over $10 billion stolen in the last five years. 2025 started with the largest hack in history, pushing the total stolen funds closer to 2024's full-year total.

Key Points

Bybit - $1.4 billion (2025) – The largest crypto hack ever, with 400,000 ETH stolen from Bybit's cold wallet. Linked to North Korea’s Lazarus Group, the exchange managed to recover losses through loans and purchases.

Poly Network - $611 million (2021) – A multi-chain protocol exploit affecting Ethereum, Polygon, and BNB Chain. The hacker later returned most of the funds, claiming it was “for fun.”

BNB Chain - $570 million (2022) – A forged transaction allowed hackers to mint 2 million BNB, though quick action limited losses to $100 million.

Ronin Network - $552 million (2022) – Axie Infinity’s bridge was exploited using stolen private keys, later attributed to North Korea’s Lazarus Group. Sky Mavis reimbursed users and tightened security.

- Coincheck - $530 million (2018) – One of Japan’s biggest exchange hacks, with 523 million NEM tokens stolen from a hot wallet. The exchange compensated users but the stolen tokens lost significant value.

Key Takeaway

While security has improved, hacks remain a major threat, with state-sponsored groups like Lazarus exploiting vulnerabilities in exchanges and bridges to steal billions.

Paradigm Appoints ZachXBT as Adviser

Background

Venture capital firm Paradigm has brought on ZachXBT, a well-known onchain cybersecurity analyst, as an incident response adviser to help safeguard its portfolio companies against exploits and cyberattacks.

Key Points

ZachXBT will continue his independent investigations into Web3 security threats while advising Paradigm.

The announcement follows the Bybit hack, where North Korea’s Lazarus Group stole $1.4 billion, the largest crypto hack in history.

ZachXBT’s past work has helped recover $350 million in stolen funds and recently linked Lazarus Group to Solana memecoin scams and the $29M Phemex hack.

- Paradigm manages over $2 billion in Web3 investments, backing companies like Coinbase, Uniswap, and Optimism.

Key Takeaway

Paradigm’s move highlights the growing need for cybersecurity expertise in crypto, especially amid record-breaking exchange hacks and sophisticated state-sponsored attacks.

Kaito AI’s $KAITO Token Surges 46%, Nears ATH Amid OKX Trading Campaign

Background

$KAITO has surged 46% daily, reaching $2.40 and approaching its all-time high, driven by new staking tiers, increased liquidity, and an OKX trading campaign.

Key Points

Market Performance: $KAITO’s FDV nears $2 billion, gaining 130% since its lows despite a bearish market.

New Staking Tiers: Kaito AI introduced a tiered staking system with voting incentives for its Yapper Launchpad, accumulating 1.5M+ votes.

OKX Trading Campaign: OKX launched a 500,000 $KAITO prize pool to boost engagement, running from Feb 26 – Mar 10, 2025.

- NFT Ecosystem Growth: The Kaito Genesis NFT floor price climbed to 3.5 ETH, signaling strong investor interest.

Key Takeaway

$KAITO’s rapid rise is fueled by staking utility, trading incentives, and ecosystem expansion, reinforcing strong market demand even in challenging conditions.

Billionaire Justin Sun Wins Reprieve as SEC Pauses Fraud Case

Background

The SEC has paused its fraud case against Justin Sun, founder of Tron and investor in Trump’s World Liberty Financial project, as both parties explore a potential settlement. This follows a broader shift in crypto enforcement under the Trump administration.

Key Points

SEC retreats on crypto lawsuits, pausing cases against Binance, Coinbase, Uniswap, Robinhood, and OpenSea.

Trump’s pro-crypto stance leads to deregulation, fulfilling promises to the industry.

Sun invested $75M in World Liberty Financial, a Trump-linked DeFi project, strengthening ties with the administration.

- TRX token price nearly doubled in a year, while World Liberty Financial holds over $9M in TRX, per Arkham Intelligence.

Key Takeaway

With the SEC scaling back enforcement, Sun and other crypto leaders benefit from Trump’s deregulatory policies, signaling a pro-crypto shift in U.S. financial oversight.

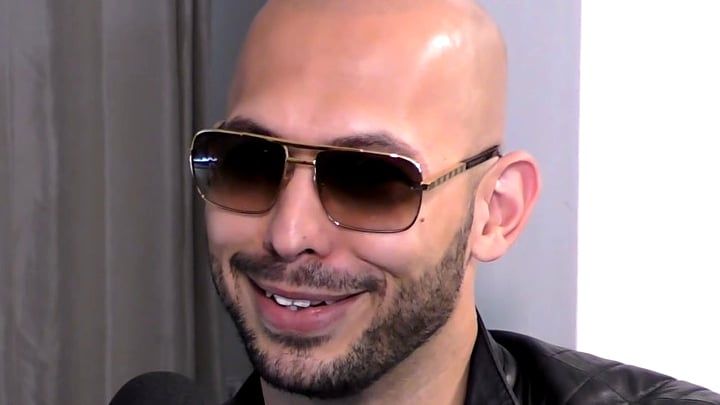

Andrew Tate’s DADDY Solana Meme Coin Jumps 78% as He Leaves Romania

Background

Andrew Tate’s Solana meme coin, DADDY, surged 78% after reports confirmed he left Romania for Florida, following U.S. diplomatic pressure under the Trump administration.

Key Points

Tate’s first departure from Romania since his 2022 arrest for alleged human trafficking and money laundering.

Trump administration intervention reportedly influenced Romanian authorities to lift Tate’s travel restrictions.

DADDY meme coin soared from $22.1M to $38.7M market cap in 12 hours, per DexScreener.

- Tate previously promoted DADDY as a counter to Iggy Azalea’s MOTHER meme coin, fueling its community-driven hype.

Key Takeaway

Tate’s travel clearance and Trump’s involvement boosted DADDY’s speculative rally, though his legal battles in the UK remain unresolved.

Dubai-Based Disrupt.com to Invest $100M in AI Startups

Background

Dubai-based VC firm Disrupt.com has announced a $100 million investment fund for AI startups focused on Web3, cybersecurity, automotive tech, and retail, aiming to capitalize on growing AI adoption.

Key Points

Disrupt.com’s founders previously built and sold Cloudways for $350 million in 2022.

MENA venture capital funding dropped 42% in 2024, but the UAE remains the largest market, raising $1.1B across 207 deals.

AI funding surges globally, with U.S. AI VC deals up 57% in Q4 2024, expected to capture 45% of all VC funding in 2025.

- AI startups leverage advancements from OpenAI & Anthropic, with generative AI inference emerging as the next major computing trend.

Key Takeaway

Despite a VC funding downturn in MENA, Disrupt.com’s $100M AI fund signals renewed investor confidence in AI-driven Web3 and enterprise solutions.

Hyperliquid Flips Solana in Fees, but Is the ‘HYPE’ Justified?

Background

Hyperliquid (HYPE), a decentralized perpetual futures exchange, has surpassed Solana in seven-day fees, generating $12.6M, outpacing Solana ($11.8M), Tron ($10.2M), and Raydium ($9.8M).

Key Points

Hyperliquid’s Layer-1 blockchain is designed for DeFi trading efficiency, featuring a fully onchain order book and zero gas fees.

HYPE token launched in November, reaching 94,000 unique addresses, with an initial $2B market cap.

Concerns over centralization, as Hyperliquid controls 78% of the stake, while its API remains closed-source.

Buyback model vs. Solana’s ecosystem fees – Hyperliquid reinvests fees into HYPE buybacks, whereas Solana distributes fees across its protocols.

- Token unlock risks – 47M HYPE tokens ($940M) set for distribution in 2026, potentially pressuring price.

Key Takeaway

Hyperliquid’s rapid rise and fee efficiency make it a dominant force in the DEX space, but centralization concerns and upcoming token unlocks could challenge its long-term sustainability.

THORChain Dev Exits After Failed Bid to Block North Korean Transactions

Background

A THORChain developer has resigned after a vote to block North Korean hacker-linked transactions was overturned, while a validator threatens to exit over the protocol’s handling of illicit funds.

Key Points

THORChain processed $605M in stolen ETH from the Bybit hack, linked to North Korea’s Lazarus Group.

Developer "Pluto" resigned, citing the protocol’s refusal to halt hacker-linked transactions.

Validator "TCB" also threatened to exit, stating THORChain is not decentralized enough to survive regulatory scrutiny.

FBI and U.S. authorities urged validators and exchanges to cut off Lazarus Group’s funds, warning of national security risks.

- THORChain founder John-Paul Thorbjornsen defended the protocol, arguing that blockchains cannot realistically censor transactions.

Key Takeaway

THORChain faces growing internal divisions and regulatory scrutiny, as its role in laundering stolen funds raises concerns about decentralization, compliance, and network governance.

Pi Network Responds to Bybit CEO’s Scam Allegations

Background

Pi Network has denied scam allegations made by Bybit CEO Ben Zhou, clarifying that a Chinese police report targeted impersonators, not the project itself.

Key Points

Bybit CEO Ben Zhou accused Pi Network of being a scam, citing a 2023 Chinese police warning about fraudulent activity.

Pi Network denied any connection to Bybit or the X account that provoked Zhou’s response.

Pi Network’s token (PI) dropped from $1.84 to $0.61 after Zhou’s post but later surged to an ATH of $2.99 on Feb. 26.

User base concerns addressed: Pi claims 60M engaged users, while blockchain explorers show 10.8M verified wallets due to KYC requirements.

- Pi app downloads exceed 100M on Google Play, reinforcing strong user interest despite skepticism.

Key Takeaway

While Bybit’s CEO publicly questioned Pi Network’s legitimacy, the project dismisses fraud claims, attributing the controversy to misinformation and impersonation scams.

Virtuals Protocol Revenue Craters by 95%

Background

Virtuals Protocol’s daily revenue has collapsed by 95%, falling from $1.1 million on Jan. 2 to just $35,000 by Feb. 27, as demand for AI agent tokens declines.

Key Points

Revenue from Virtuals’ Base Layer 2 app has been below $1,000 for 10 consecutive days.

Solana expansion failed to boost volume, as AI agent creation remains below 10 per day.

VIRTUAL token plummeted from $5.07 (ATH) to $1.06, dropping 45% in the past month amid a broader market selloff.

- Bitcoin’s 17% decline over the last month has further pressured AI-related tokens like VIRTUAL (-78% from ATH).

Key Takeaway

Virtuals Protocol is struggling with user adoption, as both its revenue and token price continue to plunge, raising doubts about sustained demand for AI agent-based economies.

Memecoins: From Social Experiment to Retail ‘Value Extraction’ Tools

Background

Once seen as community-driven digital assets, memecoins are increasingly used for insider trading, rug pulls, and retail exploitation, raising regulatory concerns in the crypto space.

Key Points

Libra (LIBRA) collapsed by 94% after insider wallets cashed out $107M, marking a $4B loss despite endorsement from Argentine President Javier Milei.

Regulatory scrutiny is increasing, with blockchain analysts warning that memecoins are becoming pump-and-dump schemes rather than community projects.

Jupiter DEX insiders reportedly knew about LIBRA’s launch two weeks in advance, raising further concerns over market manipulation.

- Trump and Melania-backed tokens (TRUMP, MELANIA) may avoid regulation, as U.S. crypto czar David Sacks categorizes memecoins as collectibles rather than securities.

Key Takeaway

As memecoin scams and insider trading escalate, regulators face pressure to differentiate between legitimate collectibles and fraudulent schemes, while retail investors remain the primary targets of value extraction.

Milei’s ‘Libragate’ Scandal Explained: What’s Behind the Controversy?

Background

Argentine President Javier Milei’s endorsement of the LIBRA token led to a massive $4 billion market collapse, triggering accusations of market manipulation, insider trading, and fraud. The scandal, now dubbed “Libragate,” has sparked legal investigations in Argentina, Spain, and the U.S.

Key Points

Milei promoted LIBRA on X, causing the token to surge to $5 and a $4B market cap before crashing 94% within hours after he deleted his post.

Lawsuits filed against Milei accuse him of fraud and illicit association, with 40,000 investors reportedly losing funds.

LIBRA was allegedly controlled by insiders, with eight wallets cashing out $107M before the crash.

U.S. regulators, including the DOJ and SEC, are investigating potential fraud and market manipulation.

- Milei denies wrongdoing, claiming he was misled and that his endorsement was part of his free-market philosophy.

Key Takeaway

The LIBRA scandal highlights the risks of political figures endorsing crypto projects, raising concerns about ethical responsibilities, regulatory scrutiny, and retail investor protection in volatile markets.

Strong Inflows into ARK 21Shares, Fidelity Bitcoin ETFs End 8-Day Outflow Streak

Background

After eight consecutive days of outflows, U.S. spot Bitcoin ETFs saw a net inflow of $94.3 million on Feb. 28, led by ARK 21Shares and Fidelity Bitcoin ETFs, as Bitcoin rebounded toward $85,000.

Key Points

ARKB and FBTC led inflows, contributing $193.7M and $176M, respectively, totaling $369.7M.

BlackRock’s IBIT saw $244.6M in outflows, partially offsetting overall gains.

Total outflows since Feb. 18 reached $3.26B, with Feb. 25 recording a record $1.13B in a single day.

Bitcoin’s price fell 17.6% from $92.5K to $78.9K, before rebounding to $86K.

- Industry analysts remain bullish, citing regulatory improvements and growing institutional interest.

Key Takeaway

While ETF outflows have dominated recent weeks, the latest inflows suggest renewed investor confidence, with analysts calling this a prime accumulation period for Bitcoin.

YZi Labs Invests in Crypto-AI Startup Vana, CZ Joins as Advisor

Background

YZi Labs (formerly Binance Labs) has invested in Vana, a crypto-AI startup focused on data ownership, with Binance co-founder Changpeng Zhao (CZ) joining as an advisor.

Key Points

Vana specializes in AI-powered data ownership solutions, aiming to empower users with control over their data.

YZi Labs’ investment signals increased institutional interest in AI-crypto convergence.

CZ’s advisory role brings strategic insight from his leadership at Binance.

- The move underscores the growing synergy between AI and blockchain, with major players entering the space.

Key Takeaway

Vana’s focus on data ownership aligns with the broader push for decentralized AI, and with CZ’s involvement, the project gains added credibility in the evolving AI-crypto landscape.

‘Hamster Kombat’ Telegram Game Launches Its Own TON Layer-2 Network

Background

Hamster Kombat, the popular tap-to-earn Telegram game, has launched Hamster Network, a Layer-2 chain on The Open Network (TON), aimed at powering games and mini-apps on Telegram.

Key Points

Built on TON, Hamster Network offers low-cost transactions and is fully compatible with TON smart contracts.

Launch includes key infrastructure, such as a wallet, asset bridge, and decentralized exchange (DEX).

Hamster Boost game introduced to test the network, rewarding users for blockchain stress-testing.

Hamster Kombat’s HMSTR token remains 76% below ATH, despite a 17% recovery following the network launch.

- Game relaunch ("HamsterVerse") includes a new GameDev Heroes mode, where players simulate running a game studio.

Key Takeaway

Hamster Kombat’s expansion into Layer-2 scaling on TON aims to enhance Telegram’s crypto gaming ecosystem, though HMSTR token struggles reflect broader market challenges.