Crypto Recap

Sep 2, 2024

Weekly Crypto Recap (Aug 26 - Sep 2)

Here’s your weekly update from Metaverse.SG, spotlighting the hottest crypto happenings of the week:

- Symbiotic vs Eigenlayer TGE

- Politics and Crypto

- EtherFi + Elixir

- Binance has launched its own PumpFun!

- Ethereum is Slowly Dying?

Jump into the latest crypto buzz!

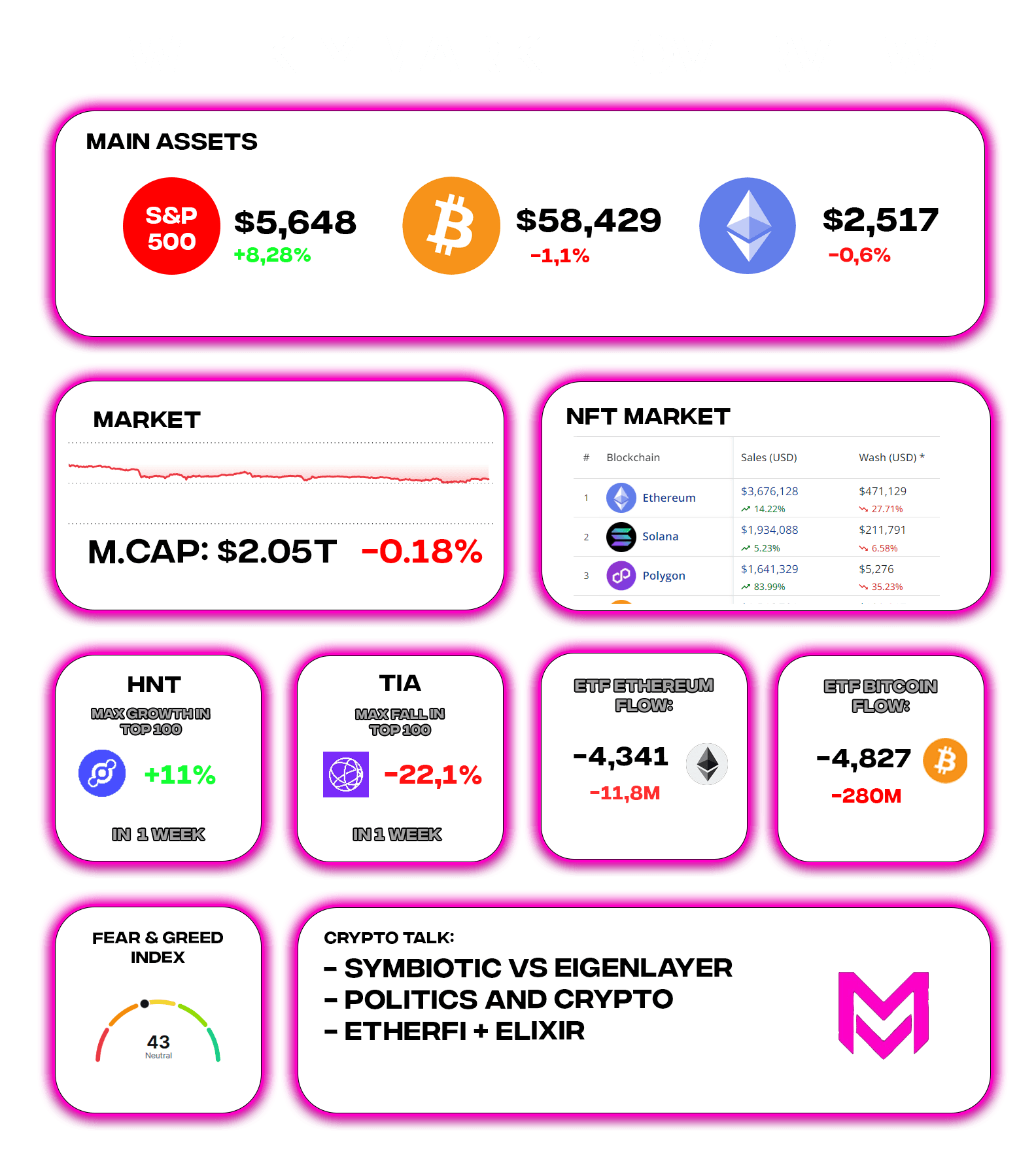

Market Overview

BTC-ETF:

- Monday: +$202M

- Tuesday: -$127M

- Wednesday: -$105M

- Thursday: -$75M

- Friday: -$175M

ETH-ETF:

- Monday: -$13M

- Tuesday: -$4M

- Wednesday: +$5M

- Thursday: $+1M

Contradictory statements about $ETH

Contradictory statements about Ethereum ($ETH) are creating a buzz in the crypto community. On one hand, Justin Bons, CEO of Cyber Capital, paints a grim picture, claiming, "Ethereum is dying while L2's dance on its grave." His statement suggests that Layer 2 solutions, designed to improve scalability and reduce costs on Ethereum, are moving beyond the original network and thriving independently, which he interprets as a sign of Ethereum's decline. This perspective implies that Ethereum's foundational issues could lead to its downfall as the ecosystem evolves.

Conversely, Ethereum's co-founder, Vitalik Buterin, takes a much more optimistic stance, emphasizing the growing stability of Ethereum. He highlights the strong collaborative spirit among Layer 2 solutions, stating, "I've talked to a bunch of L2s and there is a lot of will to work together to improve on Ethereum ecosystem-wide interoperability." Buterin's remarks underscore the efforts to enhance Ethereum's overall infrastructure and maintain its relevance, suggesting that these Layer 2 projects are not abandoning Ethereum but are, in fact, integral to its evolution and long-term success.

Symbiotic vs Eigenlayer TGE

The race is on between Symbiotic and Eigenlayer for their token generation events (TGE). While Eigenlayer has recently announced a reduction in unstaking time for $EIGEN from 24 days to 7 days, the exact date for its TGE remains undisclosed but is expected "by September 30th." Currently, $EIGEN is trading at $4.0 on WhalesMarket. Meanwhile, Symbiotic is teasing its own TGE with the cryptic message "Symtember is coming," hinting at a potential launch this month. With both platforms eyeing September for their TGEs, the competition to be first is heating up.

Politics and Crypto

Former President Donald Trump has announced his ambitious goal to make the U.S. the "crypto capital of the world," signaling a potential shift in the country's approach to digital assets. Trump's vision likely involves fostering a more favorable regulatory environment for cryptocurrencies, aiming to attract innovators and investors to the U.S. market. This approach could position the U.S. as a global leader in the crypto space, driving economic growth and technological advancement.

In stark contrast, Vice President Kamala Harris is proposing what some are calling a "Tax Armageddon," with a series of significant tax hikes that could have wide-reaching effects on both the crypto industry and the broader U.S. economy. According to Fox News, her plan includes increasing the tax on unrealized gains to 25%, raising the corporate tax rate to 28%, and boosting the income tax rate to 44.6%. Such changes could dampen investment enthusiasm, particularly in volatile sectors like cryptocurrency, where investors might be deterred by higher taxes on gains that haven't been realized. The divergent approaches of Trump and Harris highlight the ongoing debate over the U.S.'s economic and regulatory direction, particularly in relation to emerging financial technologies like cryptocurrency.

EtherFi + Elixir

EtherFi and Elixir have teamed up to launch a yield basket featuring deUSD, providing a new opportunity for stablecoin holders to maximize their returns. Users can deposit various stablecoins, including $USDC, $USDT, $DAI, $deUSD, and $sdeUSD, into this basket. In return, participants will earn multiple rewards: x5 Elixir points, x3 EtherFi points, and x3 Veda Labs points, making it an attractive option for those looking to optimize their staking strategies. Notably, withdrawals from the yield basket require a 72-hour processing period, so participants should plan accordingly.

For those who haven't yet deposited stablecoins into Elixir, depositing through EtherFi offers the most profitable route due to the enhanced rewards structure. If you've already staked deUSD and received $sdeUSD, these can also be deposited into EtherFi to earn additional points, further boosting your yield potential. For stablecoin holders in the deUSD - USDC (or USDT, DAI, etc.) liquidity pools, unstaking involves a 7-day cooldown period, during which points will continue to accrue. Once the cooldown is complete, funds can be withdrawn and deposited into EtherFi to take advantage of the new yield basket, offering a flexible and rewarding strategy for participants in the DeFi ecosystem.

Binance has launched its own PumpFun!

How to analyze crypto charts?

Conclusion:

- Stay tuned

- Stay updated instantly on our X 👉 https://x.com/MetaverseSG.

News stream

See More NewsGet the best Alpha & Market Analysis with a FREE NFT pass

Get NFT Pass